Howden's 2024 geopolitical risk report

Published

Read time

‘Holiday from history’ firmly at a close, as businesses contend with increasingly complex global risk landscape in landmark election year

- Devastating wars, geopolitical instability and weakening global trade have ended the world’s ‘holiday from history’

- As a result, global economy contends with heightened security threats, higher inflation, tighter monetary policy, supply chain disruption and tapered economic growth

- Record number of elections in 2024 set to introduce significant unpredictability into an already volatile risk environment

- Report underscores the critical role insurance plays in engendering resilience amidst unrelenting geoeconomic uncertainty

London, 26 March 2024 – Howden releases its 2024 Geopolitical Risk Report, 2024: a turning point?. The report portrays a highly complex and changeable risk landscape that traverses macroeconomics, geopolitics and technology, with economic uncertainty and an upsurge in armed conflict coinciding with a slew of high-profile elections in 2024.

Landmark year for elections presents known unknowns for businesses

With the ‘biggest election year in history’ taking place in 2024, businesses and (re)insurers face considerable uncertainty, with some 60 countries, accounting for approximately 40% of the world’s population and gross domestic product, due to hold votes.

The potential for political instability presents a major risk for 2024, with pre-existing grievances tied to the rising cost-of-living, food and energy insecurity, falling real incomes and high levels of debt generating more frequent acts of violence. These factors are being further inflamed by populism and polarisation, along with concerns that misinformation could undermine the democratic process.

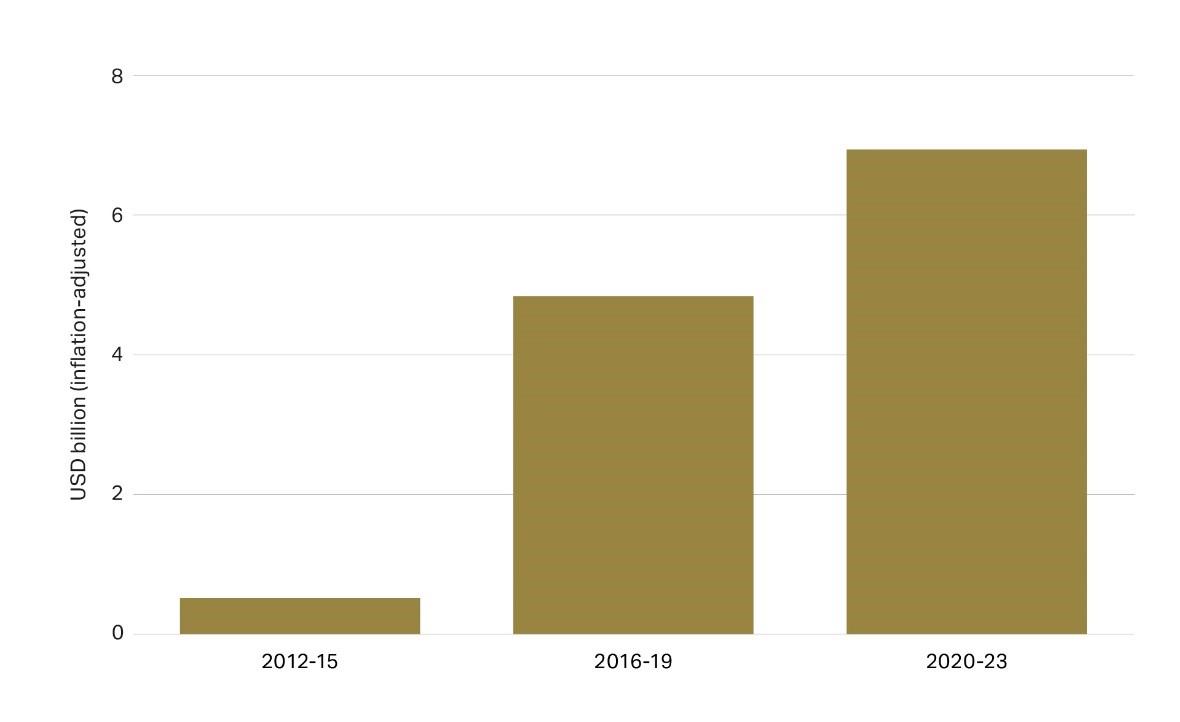

Howden data shows that insured losses from civil unrest have risen significantly over the last decade to total USD 7 billion in 2020-23. Rather than a series of random acts, recent losses from civil unrest are a manifestation of a highly challenged macro-environment, fuelled further by the proliferation of technology and the reach provided by smartphones and social media platforms.

Insured losses from civil unrest by 4-year period – 2012 to 2023

(Source: Howden, NOVA)

Sandy Warne, Head of Terrorism and Political Violence, Howden Tiger, said: “This year’s election cycle is set to introduce an additional dose of unpredictability into an already volatile environment. Businesses need to prepare for, and protect themselves against, escalating political-related risks, underscoring the value of political violence and political risk insurance.

“Changes in governing parties can transform companies’ exposures overnight due to major deviations in policy, contract cancellations or even debt defaults. Such a backdrop not only brings direct financial risks from property damage and business interruption, but can also threaten operations, personnel, supply chains and reputations. Howden is closely monitoring global developments and stands ready to support clients through this highly fluid period.”

In addition to election uncertainty, heightened geopolitical tensions, and the risk escalation in global hot spots, are constant threats

Businesses globally are not only contending with the uncertainty posed by a landmark year of elections. Conflicts in the Middle East and Ukraine, along with persistent tensions across the Taiwan Strait, threaten energy security, global supply chains, international trade, and, by extension, resurgent inflation.

Geopolitical fragmentation is also causing structural shifts in global commerce following Russia’s invasion of Ukraine by redrawing trade maps across the world and bringing the potential for significant changes to supply chains. All of which underscores the need for companies to secure supply chains and reduce reliance on geopolitical hotspots.

Disruption to shipping in the Red Sea is the latest shock to trade. Resurgent activity by Somali pirates has also been recorded recently. The marine war insurance market continues to support vessels transiting volatile areas, with pricing adjustments reflecting heightened risks. Freight rates have also increased, with third-party data (from Freightos) showing a three-fold increase for certain routes since the start of the crisis. They nevertheless remain well below levels reached in 2021/22 and have moderated in recent weeks.

Julian Alovisi, Head of Research, Howden, concludes: “2024 looks set to be a year that will shape global developments for some time to come. Continued macroeconomic uncertainty, heightened geopolitical risk and a unique election cycle are indicative of the high-risk environment businesses have been navigating since the turn of the decade, as well as the importance of risk transfer in sustaining global commerce through such disruption.

“After five years of near-uniform hardening in the insurance market, conditions in 2024 look set to be more favourable for buyers as competition yields increased capacity and more stable pricing. By stepping up at this time of macroeconomic and geopolitical instability, insurance is underpinning economic resilience and creating new opportunities for growth as impetus shifts from pricing tailwinds to finding new solutions that meet clients’ rapidly changing needs.”